Big Mortgage Changes Are Making Homeownership Easier in 2025 🏡

A Big Change in How Lenders Evaluate Credit 🔍

If you’ve ever been turned down for a mortgage because your credit score was a few points too low, you’ll want to hear this.

Fannie Mae just announced a major change that could open the door to homeownership for more people—especially first-time buyers or those with limited credit history.

Starting November 16, 2025, loans submitted through Fannie Mae’s Desktop Underwriter® (DU) system will no longer require a minimum credit score.

This means lenders can now approve a borrower even if their score falls below the old 620 threshold, as long as other parts of their financial profile show responsible credit behavior and manageable risk.

What’s Actually Changing 🧾

Here’s what Fannie Mae said in its Selling Guide Announcement SEL-2025-09:

“Minimum credit score requirements will no longer apply to loans submitted to DU… DU will assess a borrower’s creditworthiness based on a comprehensive evaluation of risk factors.”

In simple terms:

-

Old rule: Borrowers typically needed a credit score of 620 or higher to qualify for a conventional loan.

-

New rule: DU will now evaluate borrowers on a wider range of factors—payment history, income, assets, and overall financial stability—not just one number.

This doesn’t mean credit scores are disappearing. Lenders will still use them to determine interest rates and loan-level price adjustments.

But the hard “cut-off” score that blocked many qualified buyers is now gone for DU-eligible loans.

Why This Matters for Buyers 🧑💼

For buyers with strong income, steady employment, or a history of on-time rent and utility payments, this update could make all the difference.

Even if your credit score is below 620—or if you have what’s called a “thin” credit file—you may now have a better chance of getting approved for a conventional mortgage.

That said, approval isn’t automatic. Lenders will still review the full picture of your finances.

Each lender can apply its own overlays or stricter internal standards, so you’ll want to check with a licensed mortgage professional for specifics.

How Lenders Will Implement It 🏦

While the policy officially takes effect for new DU casefiles created on or after November 16, each lender may adopt it at a different pace.

Manual-underwriting loans (those not run through DU) still follow traditional minimum-score requirements—generally 620 for fixed-rate conventional loans.

Over time, though, as lenders update their systems, we’ll likely see more approvals for buyers who previously fell just short of qualifying.

What Homebuyers Should Do Now ✅

-

Check your credit reports – Make sure there are no errors or outdated negatives.

-

Gather proof of steady income – Paystubs, W-2s, bank statements, and rent receipts all help show strong financial behavior.

-

Talk to a lender early – Ask whether they’re using the updated Fannie Mae DU system and how the change could impact your approval chances.

-

Stay realistic – Lower credit scores can still mean higher rates or extra documentation requirements, even with these new rules.

Bottom Line 🧠

This Fannie Mae update is good news for homebuyers. It gives lenders more flexibility to evaluate the whole borrower, not just a single score.

If you’ve been discouraged in the past, this could be the right time to take another look at your home-buying options.

⚠️ Disclaimer

This article is for informational purposes only and should not be considered financial, lending, or legal advice. Mortgage guidelines and lender policies can change at any time.

Always consult with a licensed mortgage lender or financial professional to determine your specific eligibility.

Thinking about buying your first home?

Let’s talk about how these changes could help you qualify today.

📧 contact@kennethhoffmaster.com

🌐 www.KennethHoffmaster.com

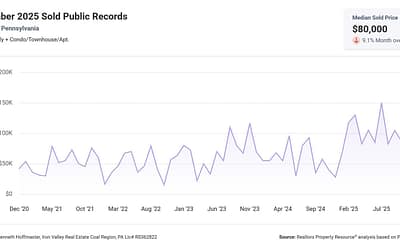

Pottsville, PA Real Estate Market Update – December 2025: What Buyers & Sellers Need to Know

Pottsville’s real estate market remains seller-leaning as we close out 2025, with low inventory, steady buyer activity, and strong long-term property values. Here’s a clear, data-driven breakdown of what’s happening locally — and what it means if you’re buying or selling in 2026.

How To Stretch Your Options, Not Your Budget

One of the biggest homebuying advantages you can give yourself today is surprisingly simple: a flexible wish list. Think of it like this. Your wish list and your budget are the guardrails of your search. And when your budget needs to hold firm, there’s another lever...

Your Equity Could Change Everything About Your Next Move

A lot of people are asking the same thing right now: “Is it even a good time to sell?” And the truth may come as a bit of a surprise... For many homeowners, the answer is a strong yes. Why? Because of one major factor working in your favor: your equity. Odds are, if...

Why Selling Your House This Winter Gives You an Edge

Spring gets all the attention, but it’s not always the best time to sell a house. Yes, more buyers show up, but so do a lot of other sellers. Winter is different. With fewer homes on the market, your house has a much better chance of standing out. And that one...

This May Be the Best Time To Buy a Brand-New Home

New home construction today is giving buyers something it feels like they haven't gotten much lately: a real shot at both the home they want and the deal they need. More brand-new options are on the market right now, and builders are rolling out incentives that make...

Why More Homeowners Are Giving Up Their Low Mortgage Rate

If you’re like a lot of homeowners, you’ve probably thought: “I’d like to move… but I don’t want to give up my 3% rate.” That’s fair. That rate has been one of your best financial wins – and it can be hard to let go. But here’s what you need to remember... A great...

The 3 Housing Market Questions Coming Up at Every Gathering This Season

Whether it’s at a family gathering, your company party, or catching up with friends over the holidays, the housing market always finds its way into the conversation. Here are the top three questions on a lot of people’s minds this season, and straightforward answers...

How To Find the Best Deal Possible on a Home Right Now

Want to know how to find the best deal possible in today’s housing market? Here’s the secret. Focus on homes that have been sitting on the market for a while. Because when a listing lingers, sellers tend to get more realistic – and, more willing to negotiate. And...

Why So Many People Are Thankful They Bought a Home This Year

Homebuyers are weighing their options right now, and they certainly have a lot on their minds. With everything going on in the job market, the economy, and more – there's a lot to think about these days. And maybe that’s making you wonder if it really makes sense to...

Why Buying a Home Still Pays Off in the Long Run

Renting can feel much less expensive and much simpler than buying a home, especially right now. No repairs, no property taxes, no worrying about mortgage rates – you just pay the bill and move on with your life. But here’s the part people don’t talk about enough:...